What are AI agents and why do they matter?

Why AI agents?

In the fast-evolving world of financial services, staying ahead of change is a challenge. From regulatory updates to shifting client expectations, it can feel like a never-ending race.

AI agents are poised to help us not just keep up but get ahead. They’re not just another AI tool – they’re partners that think, plan, and act. Let’s break down what they are and why they matter.

Generative AI: Powerful, but limited

Generative AI has amazed us with:

✅ Creative writing

✅ Data insights

✅ Conversational fluency

But there’s a problem: these models are reactive. They produce outputs but can’t take action themselves.

🔒 Limitations:

- Can’t initiate actions

- Need step-by-step prompting

- Lack persistent memory

AI agents: The next leap forward

AI agents combine the best of generative AI with reasoning, planning, and autonomous execution.

Key features:

- 🧠 Perception – Understand data from multiple sources

- 📊 Decision-making – Weigh options, consider risk, and plan

- 🤖 Action – Take steps in real time

- 🔄 Learning – Get smarter over time

- 🔐 Control – Stay secure and compliant

.png)

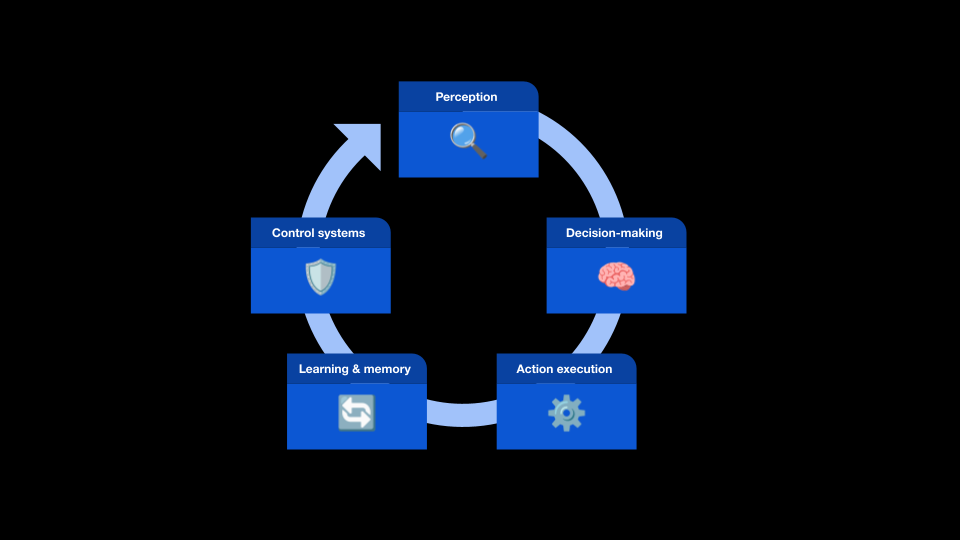

How they work: Five core components

Here’s how AI agents function as a complete system:

1️⃣ Perception

- Take in structured and unstructured data

- Example: Client profiles, financial records, market updates

2️⃣ Decision-making engine

- Reason, weigh risks, and find the best way forward

- Example: Balancing returns with risk tolerance

3️⃣ Action execution

- Trigger real-world processes or digital tasks

- Example: Scheduling meetings, sending reminders

4️⃣ Learning & memory

- Learn from outcomes and refine processes

- Example: Adapting recommendations based on client feedback

5️⃣ Control systems

- Keep everything safe and aligned with regulations

- Example: Ensuring compliance with FCA guidelines

Why this matters for financial advice

The benefits for advisers and clients are huge:

✅ Time savings – AI agents can handle repetitive admin tasks.

✅ Better decisions – They process data holistically and can spot patterns humans might miss.

✅ Improved client outcomes – Faster onboarding, tailored advice, and more personalised service.

💡 Example: Imagine no more back-and-forth emails just to gather documents. The AI agent can prompt clients automatically, verify data, and highlight any risks – all while you focus on building relationships and offering real expertise.

.png)

It’s about partnership, not replacement

AI agents aren’t here to take over your job – they’re here to amplify what you do best. Think of them like a tireless colleague who never sleeps and always has the data at hand.

👉 Key takeaway: Use AI agents to do the legwork, so you can focus on strategy, relationships, and truly personal financial guidance.

Next steps: what’s the opportunity for your firm?

As AI agents evolve, the key is finding the right starting point:

- Where could you free up time and reduce admin?

- Which processes would benefit from 24/7 operation?

- How can AI agents complement your human expertise?

💡 Call to action: Start small. Test these systems in one area of your workflow. Let them prove themselves. Then build from there.

The big picture: a transformative future

Our white paper makes it clear: AI agents aren’t just a shiny new tool. They’re a strategic asset – a chance to reshape how we work and how we serve clients.

Financial services have always been about trust, insight, and relationships. AI agents won’t change that. They’ll enhance it, making you faster, smarter, and more adaptable.

Ready to explore the power of AI agents?

Let’s start the conversation. 🚀✨

🚀 Want to explore this in more detail?

Download the full white paper to get the complete view – packed with insights and practical guidance for financial professionals.